Silver

Embrace the Timeless Value of Silver

Silver has long captivated the imagination of investors and collectors alike. This precious metal is renowned for its intrinsic value, shimmering allure, and diverse applications. Beyond its aesthetic appeal, silver plays a pivotal role in investment portfolios, offering a unique blend of stability, growth potential, and resilience against economic uncertainties. As a vital component of a well-rounded portfolio, silver not only acts as a hedge against inflation but also leverages industrial demand, making it an indispensable asset for savvy investors.

The Historical Significance of Silver

Silver's journey through time is a testament to its enduring value and multifaceted utility. From its origins in ancient civilizations to its critical role in modern economies, silver has been a symbol of prosperity and trade for millennia. In early societies, silver coins were a primary medium of exchange, while its reflective properties found use in art and adornment. In today's market, silver continues to shine brightly, driven by technological advancements and an ever-present demand for this versatile metal.

Silver's Role in the Modern Investment Landscape

As economic landscapes shift, silver emerges as a valuable commodity, integral to both traditional and contemporary investment strategies. Rising industrial usage in electronics, solar energy, and healthcare underscores its utility beyond mere ornamentation. Current market trends indicate an increasing demand for silver due to its affordability relative to other precious metals, making it accessible to a wide range of investors. Consequently, silver remains a sought-after asset for diversifying portfolios, mitigating risk, and preserving wealth in a volatile economic environment.

Key Benefits of Investing in Silver

Investing in silver offers numerous advantages that appeal to both novice and seasoned investors. Its high liquidity ensures that investors can buy and sell with ease, while its tangible nature provides a sense of security. Silver's role in industrial applications adds another layer of demand, further supporting its value. Importantly, it allows investors to diversify their portfolios, acting as a counterbalance to stocks and bonds and reducing overall risk exposure.

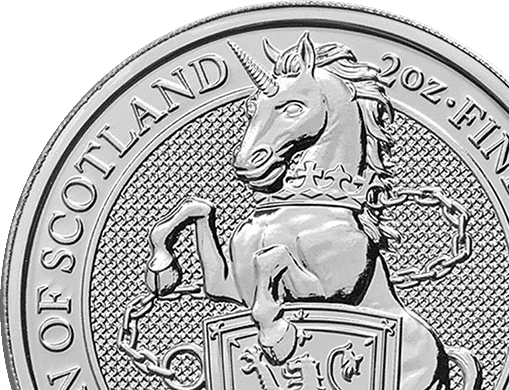

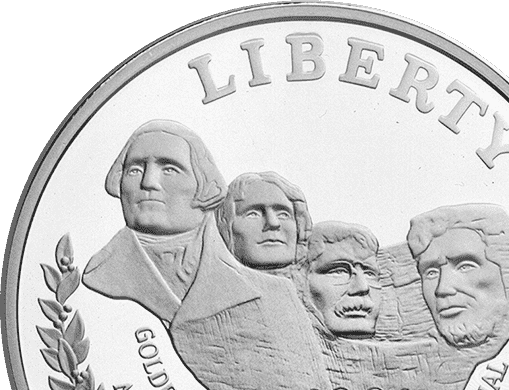

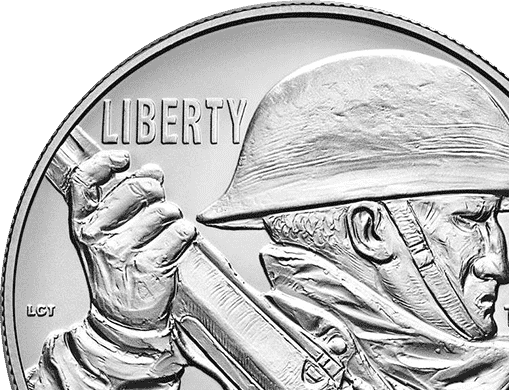

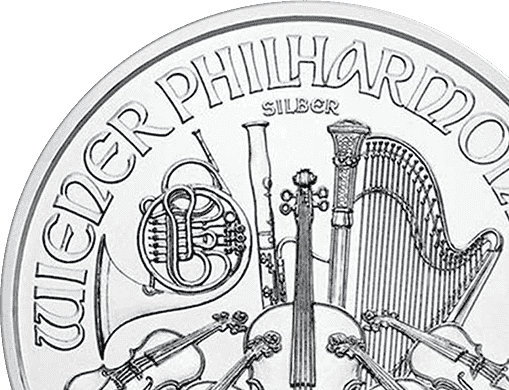

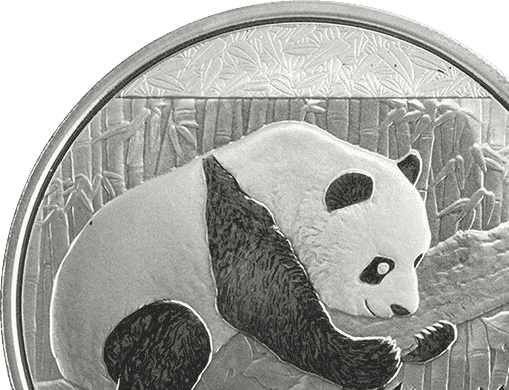

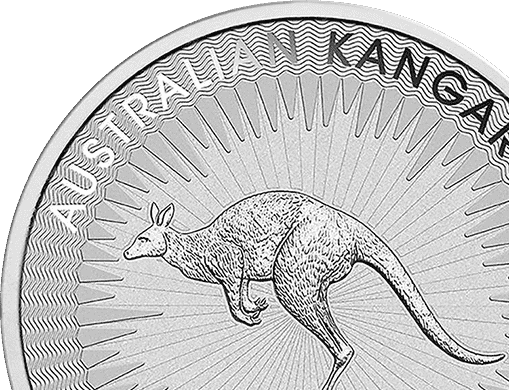

Diverse Varieties of Silver Products

Silver investments come in various forms, each offering unique benefits and features. Common formats include silver bars, coins, and rounds, each varying in size, weight, and design. Silver bars are favored for their lower premiums and ease of stacking, while coins attract collectors due to their intricate designs and historical significance. Popular silver coin options include the American Silver Eagle and the Canadian Silver Maple Leaf, celebrated for their purity and craftsmanship.

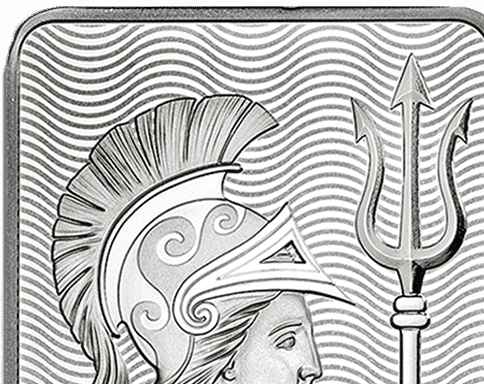

Notable Silver Products and Features

When choosing silver products, consider factors such as size, weight, and purity. Silver bars typically range from 1 ounce to 100 ounces, with larger bars often providing lower premiums per ounce. Coins, like the Silver Britannia, boast intricate designs and legal-tender status. Many products also come with added security features like laser engraving or mint marks, assuring authenticity and quality. Notable mints include the Royal Canadian Mint and the United States Mint, famed for their trusted craftsmanship and innovation.

Renowned Manufacturers and Mints

The world of silver is populated by esteemed manufacturers and mints, each contributing to the integrity and allure of this precious metal. The Perth Mint, known for its stunning design and innovation, consistently releases collectible coins that captivate both investors and numismatists. Meanwhile, the PAMP Suisse and Engelhard are renowned for their impeccable silver bars, recognized worldwide for their consistency and purity.

Strategic Investment Approaches with Silver

Incorporating silver into investment strategies can enhance portfolio performance across different time horizons. For short-term investors, silver options present opportunities to capitalize on market fluctuations, while long-term holders benefit from its steady appreciation and industrial growth. Diversifying with silver helps balance risk, complementing securities and real estate holdings to achieve a more resilient and profitable portfolio.

Purchasing and Safeguarding Your Silver Investments

When purchasing silver, consider factors like weight, price, and premiums to ensure value. Online retailers, including Bullion Standard, offer a transparent purchasing process, with competitive pricing and secure transactions. Proper storage is crucial; options range from home safes and bank safety deposit boxes to professional vault services, which offer robust security measures and insurance to protect your investment.

Why Bullion Standard Stands Out

Choosing Bullion Standard for your silver investments ensures access to high-quality products, coupled with expert customer service. Our commitment to transparency and excellence guarantees a seamless buying experience, whether you're seeking individual coins or substantial bars. Enjoy competitive prices, a user-friendly platform, and unconditional dedication to your investing needs, all hallmarks of our distinguishing service.

Embark on Your Silver Investment Journey

Explore the rich offerings of our silver category and start securing your financial future today. Our customer support team is readily available to provide personalized assistance and address any inquiries you may have. Dive into the world of silver, capitalize on its robust potential, and enhance your investment portfolio with confidence.